Financial Records Management Certificate

Master the practical skills needed to handle business financial records with confidence. Our six-month intensive program covers everything from daily bookkeeping to year-end compliance, taught by professionals who've actually worked in the field.

Request Program Details

Program Overview

Starting September 2025, our evening classes run twice weekly. You'll work through real scenarios drawn from actual businesses operating across Darwin and regional Northern Territory.

Weeks Duration

Classes meet Tuesday and Thursday evenings from 6pm to 9pm. Expect around five hours of weekly practice outside class time.

Contact Hours

Direct instruction time with working professionals. Small groups mean you get specific answers to your questions.

Core Modules

Each module builds on previous concepts. Miss a session and you'll need to catch up before the next one starts.

What You'll Actually Learn

We skip the theory-heavy stuff and focus on what you need to know for daily work. Here's what each module covers and why it matters.

Foundation Records & Daily Transactions

Setting up chart of accounts, recording sales and purchases, bank reconciliation. This is where most mistakes happen in real businesses, so we spend three weeks here getting it right.

Payroll & Employee Records

Calculating wages, superannuation, PAYG withholding, and Single Touch Payroll reporting. Australian payroll has specific requirements that trip up new bookkeepers constantly.

GST & BAS Preparation

Understanding when GST applies, preparing Business Activity Statements, dealing with common GST mistakes. You'll prepare actual BAS returns using sanitized data from real businesses.

End of Financial Year Procedures

Stocktakes, depreciation, accruals and prepayments, preparing for tax returns. The EOFY rush is stressful enough without wondering if you've done everything correctly.

Software Applications

Hands-on work with MYOB, Xero, and QuickBooks Online. We teach concepts first, then show you how each platform handles them differently.

Financial Reporting Basics

Reading P&L statements and balance sheets, preparing management reports, spotting problems in financial data. Business owners need this information to make decisions.

Your Instructors

Everyone teaching this program currently works in the field. They know what employers expect because they hire bookkeepers themselves.

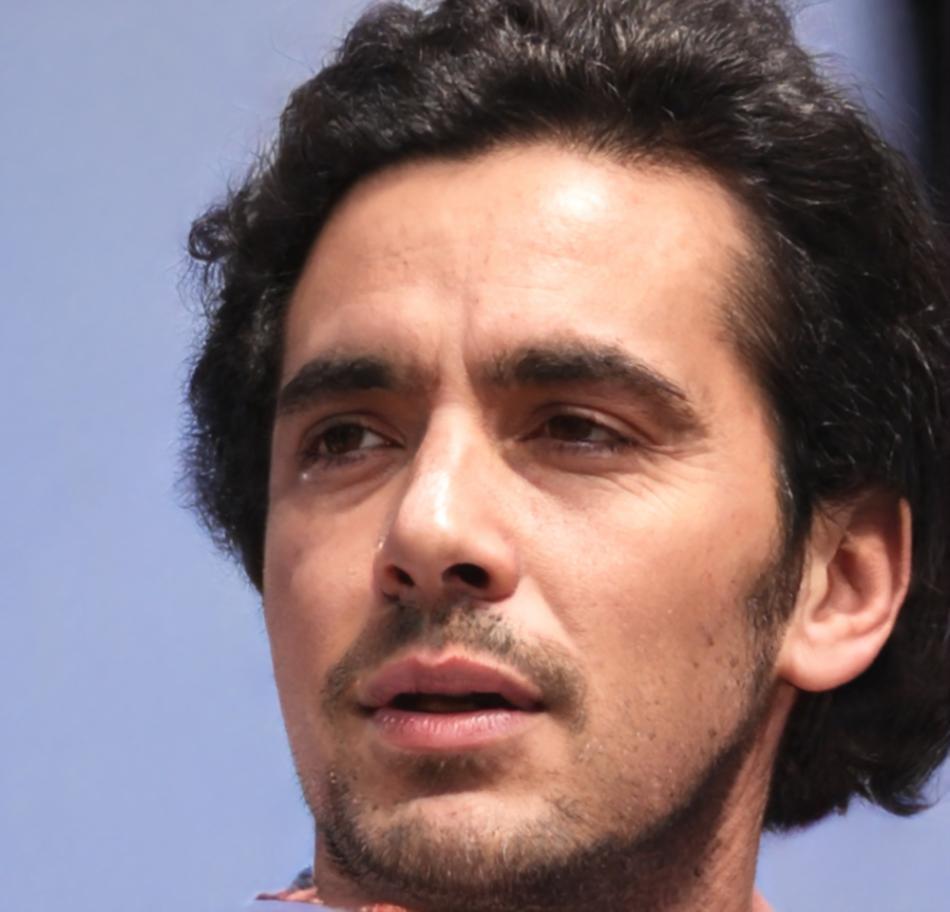

Roderick Vance

Practice Manager

Sylvia Pemberton

Payroll Specialist

Gareth Thorne

Compliance Advisor

Neville Ashford

Systems Coordinator

How Enrollment Works

Applications for our September 2025 intake open on March 15th. We cap enrollment at eighteen students to keep class sizes manageable.

No prior bookkeeping experience is required, but you should be comfortable with basic computer use and spreadsheets. If you've never used Excel, spend some time with it before starting the program.

-

1March 15, 2025 Applications open with initial information session

-

2April 20, 2025 Application deadline and phone interviews

-

3May 10, 2025 Enrollment confirmations sent out

-

4September 2, 2025 First class begins at our Darwin location